Breaking News

Finance

Unveiling the New Elite: Surge in Bitcoin Value Breeds Cryptocurrency Millionaires

Leo Gonzalez

March 11, 2024 - 17:27 pm

Bitcoin's Surge Engenders New Wave of Crypto Millionaires

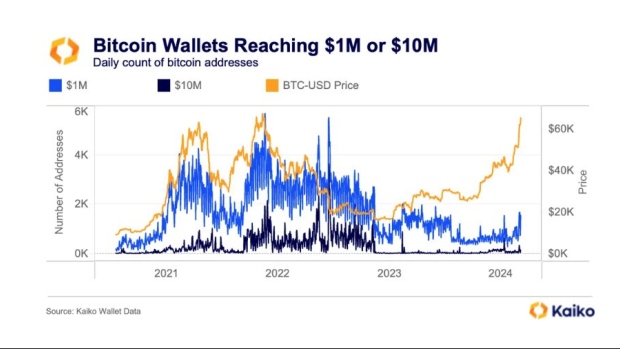

In an unprecedented ascent, Bitcoin's value has galvanized a phenomenon of creating approximately 1,500 new "millionaire wallets" per day, delineated by the cryptocurrency intelligence entity Kaiko Research. These wallets, integral to the architecture of the Bitcoin blockchain, present a digital berth for the safekeeping of cryptocurrency holdings. The transparency of the blockchain network affords public access to metrics such as token quantities within any given wallet. Despite this openness, the intrinsic anonymity of the wallet addresses poses a challenge in pinpointing the precise nature of their ownership, shrouding the identity of whether they belong to individual investors or corporate entities.

A Year of Record Gains

The trailblazing cryptocurrency has witnessed an approximately 70% increment in value since the commencement of the year. This investor fervor largely credits the burgeoning demand for US exchange-traded funds (ETFs), which, as of January, have been authorized to encompass Bitcoin within their investment purview. However, it's noteworthy that the current frequency of millionaire wallet emergence pales in comparison to the bull-market expedition of 2021, which observed in excess of 4,000 wallets daily breaching the million-dollar threshold. The zenith for this year was recorded on March 1, when a staggering 1,691 wallets achieved millionaire status.

A Slower Pace of Affluence Accumulation

Several contributory factors can be postulated for this moderated pace of wealth accumulation in the Bitcoin ecosystem. One perspective suggests the potential lag in the injection of fresh capital into the market. Another angle considers the possibility of seasoned investors, colloquially termed 'whales', securing profits and liquidities as Bitcoin reaches its stratospheric heights. It may also be surmised that such whales are entrusting their holdings to custodial services as opposed to managing personal wallets, a strategic shift highlighted by Kaiko in its Monday report.

Reflection of Past Crypto Hustle

In stark contrast to the current climate, the year 2021 was characterized by a formidable wave of capital influx, sparked by investors from all walks eagerly seeking to capitalize on the crypto frenzy. The current scenario, however, seems to be painted with a stroke of caution. As denoted in the report from Kaiko Research, this cycle witnesses whales adopting a more measured approach, perhaps biding their time to assess the longevity and stability of these financial gains before commencing further investment. Such wariness appears to suggest a maturing market where the previous exuberance is now tempered by strategic patience.

Analyzing the Market Dynamics

The cultivation of these millionaire wallets is not merely a feat of luck but a clear reflection of the underpinning dynamics at play within the cryptocurrency marketplace. The acceptance of Bitcoin ETFs in the US has played a considerable role in the coin's valuation, providing investors with a mainstream financial vehicle to gain exposure to this digital asset class. On the other hand, the comparison with the previous year's highs draws attention to the evolving landscape of crypto investment strategies and market participants' sentiment.

Insights From Kaiko Research's Findings

Kaiko Research's analytical prowess sheds light on the intricate nuances of the cryptocurrency market's evolution. Their insights provide valuable perspectives for both seasoned and novice investors to navigate this volatile and often unpredictable financial terrain. Understanding these metrics and trends is vital for crafting informed investment decisions and capitalizing on the digital currency revolution.

Bitcoin's Bullish Continuance

Despite the signs of a cautious market, the overall trajectory for Bitcoin appears to remain bullish. Investor enthusiasm does not seem to be waning as the allure of high returns draws in both old players and curious newcomers to the field. The creation of millionaire wallets, although decreased from the previous year's rush, is still a significant indicator of wealth generation and investor confidence within the crypto space.

The Interplay of Whales and the Market

Examining the behaviors of 'whales'—entities or individuals holding substantial amounts of Bitcoin—offers profound insights into the market's current state. Their actions, ranging from profit-taking to opting for custodial solutions, impact the liquidity and stability of the cryptocurrency. Analysts scrutinize these developments closely, as they can unveil underlying market sentiments and potential triggers for future price movements.

Incorporating Bitcoin in Institutional Portfolios

The inclusion of Bitcoin in ETFs underscores a significant milestone for its integration into broader institutional investment strategies. This legitimization by traditional financial structures paves the way for more secure and compliant avenues for investors to interact with Bitcoin, potentially ushering in a new era of institutional endorsement and stability in its valuations.

The Evolution of Digital Wallets

Against the backdrop of an increasing number of millionaire wallets, it is imperative to understand the role and evolution of digital wallets in the cryptocurrency sphere. As the primary means for investors to store and manage their digital assets, wallets have become more sophisticated, aligning with the security demands of an ever-increasingly savvy investor base. The shift towards custodial wallet solutions by prominent players in the market reflects a trend towards prioritizing security and professional asset management within the industry.

Traditional Finance Embraces Crypto

The year 2023 marks a pivotal chapter in the melding of cryptocurrency with conventional financial systems. The approval of Bitcoin ETFs serves as a testament to the growing acceptance and regulatory clarity around cryptocurrencies. This amalgamation is poised to diversify investment portfolios and inject a new layer of dynamism into the financial sector, as digital currencies become increasingly assimilated within the fabric of traditional investment frameworks.

Strategic Considerations for Crypto Investors

Given the surge in the number of millionaire wallets and the sophisticated nature of the current market, investors are urged to adopt a strategic lens when dealing with cryptocurrencies. Considering factors such as market sentiment, regulatory changes, and the actions of major players, would be prudent. A meticulous approach can help mitigate risks and maximize the potential for sustained gains.

The Future of Crypto Wealth Distribution

While the present trend suggests a growth in the distribution of crypto-based wealth, it is essential to speculate on what the future holds for the structure and demographics of wealth within the cryptocurrency domain. As the market matures and more investors get on board, we may witness a more diverse and equitable spread of digital wealth, possibly altering the current landscape dominated by whales and early adopters.

Kaiko Research: A Pivotal Source for Crypto Analytics

The pivotal role of Kaiko Research as an authority in crypto analytics cannot be overstated. Their reports and data become indispensable tools for those navigating the complex cryptocurrency market. Their continual assessment of trends, wallet growth, and market sentiment forms the cornerstone of informed decision-making in an otherwise opaque and speculative environment.

Bitcoin's Role in the Emerging Financial Ecosystem

Bitcoin's ascendancy and its ability to create millionaire wallets at a rapid clip is reflective of its increasingly prominent role in the emerging financial ecosystem. Its integration into ETFs and the growing interest from institutions and individual investors alike suggest a robust future where Bitcoin, and cryptocurrencies in general, could potentially serve as cornerstones of diversified portfolios.

Navigating the Path Ahead

For participants within the cryptocurrency market, the path ahead demands astuteness and the capacity to interpret and react to the market's signals. As the landscape continues to evolve, staying informed and agile will be critical for those looking to not only preserve but also enhance their crypto-wealth in the long run.

Conclusion: The New Era of Crypto Millionaires

Bitcoin's trailblazing rally and the attendant rise in the number of millionaire wallets underscore a foundational shift within the cryptocurrency arena, heralding the advent of new market dynamics and wealth distribution patterns. The insights rendered by Kaiko Research, alongside other analytics firms, provide a navigational chart for market participants eager to ride the waves of this digital revolution.

Moreover, the industry's gradual embrace by conventional financial systems embodies the metamorphosis of Bitcoin from a fringe investment to a mainstream asset. As new millionaire wallets continue to burgeon, they will serve as the markers of success stories within the ever-expanding crypto universe. For more information and insights from Kaiko Research, readers are encouraged to visit their official link.

With the Bitcoin fervor showing little signs of abatement, the creation of new millionaire wallets is expected to persist, albeit at a moderated pace that signals the market's maturing visage. Investors who adeptly navigate this landscape may well find themselves at the forefront of the next wave of crypto-millionaires, emblematic of a new epoch in wealth creation.

In sum, while the ebbs and flows of the Bitcoin tide continue to shape the landscape, what remains constant is the currency's capacity to forge new frontiers in the realm of digital wealth. The penchant for investment in Bitcoin and other cryptocurrencies showcases an economy in transition, one that continues to unravel new opportunities and challenges for those bold enough to engage with it.

aerospace daily news© 2025 All Rights Reserved